TANG PALACE (CHINA) HOLDINGS.LTD (1181.HK)

Stock Commentary Date: 05/11/2018

Stock: TANG PALACE (CHINA) HOLDINGS.LTD (1181.HK)

Closing price: $1.15 (04/11/2018)

52 weeks range: $1.09 – 1.891

Shares outstanding: 1,068,617,500

Market Capitalization : HK$ 1229 Million (04/11/2018)

Target Price (12 months): Neutral

Business Summary:

1. Tang Palace (China) Holdings Ltd. is an investment holding company engaged in the restaurants operation. The company operated through its own brands as well as through franchising.

2. The brands operated by the Company include: Tang's Cuisine (唐宫壹号),Tang's Palace (include Tang Palace Seafood Restaurant and Tang Palace, 唐宫 包括唐宫海鲜和唐宫),Social Place (唐宫小聚),Canton Tea Room (唐宫茶点)and Ninja House Japanese Restaurant (忍者居)。The company also operated franchise brand “Pepper Lunch” and formed a partnership with their Malaysia business partners to operate “PappaRich” (金爸爸).

3. The company operated 58 restaruants and 6 other restaurants under joint ventures (as on 30 June 2018). The company mainly operated through three business segments: the Southern China region, the Eastern China and the Northern China region. The largest section was in Eastern region

Business Report:

1. For the six months ended 30 June 2018, revenue of the Group increased by RMB 80.4 million or 12.2%, to RMB 740.2 million as compared to the same period 2017. Although the Group managed to increase the revenue in this competitive industries, the rising cost affected the company's profit. Net income decreased by 15% RMB 53.16 million.

2. The Group's Southern China segment and Western China segment performed well in the first half of 2018 due to its strategic change and reflected on the Group's revenue, revenues were increased by 26% to RMB 192.9M and 96% to RMB 45.6M respectively. While Northern China as well as Eastern China segment revenue grew by 6% to RMB 199 million and 3% to RMB 329 million. The Group's net income decrease was also contributed by the 35% drop in net income with the Eastern China Segment.

3. The Group's largest cost were inventories consumed (which includes food consumables, utensils etc) and staff. In the first half of 2018, both items increased by 17% and 18%, from RMB 232 million to RMB 273 million and RMB 191 million to RMB 227 million respectively.

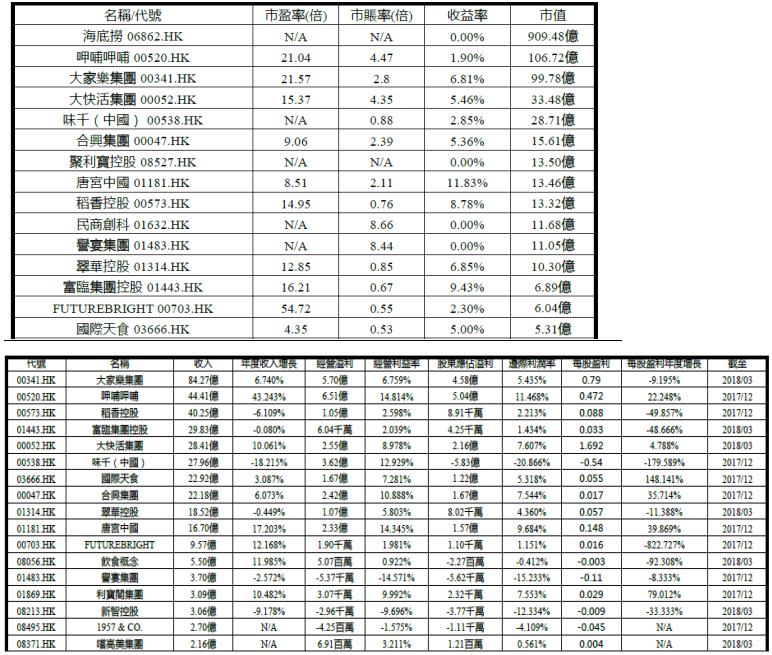

Peer Comparison:

SWOT ANALYSIS:

Strength :

- China's catering service market generated approximately RMB 4000 billion revenue in 2017. It is expected this sector to continue to grow at a CAGR of 9.6% from 2017 to 2022.As for Hong Kong, the market generated approximately HKD 107 billion in revenue in 2016 and expected to grew by a moderate CAGR of 4.7% from 2016 to 2021.The focus is clearly in China

- The company recognised the rapid growth in the online takeway business and formed a close relationship with various platforms such as waimai baidu (百度外卖), daojia.com (到家美食), ele.me (饿了麽) and meituan.com (美团网) in order its online sales.

Weakness :

- Lack of brand diversification

.

Opportunities :

- Online take away business.

- Sales of convenient dishes thru online store, “WeiMall”

Threat :

- Rising staff as well as basic materials

- Slowdown in economy due to trade war, which in turn slowdown consumption.

「注:本人倪国权为证监会持牌人士。截至本评论文章发表日止,本人及/或其有联系者并无持有全部提及之证券的所有相关财务权益。」; Or

” I, Ni Kwok Kuen Alex, am a licensed person under the Securities and Futures Commission. Until the date this commentary was published, neither I and/or my affiliates are the beneficiary of the securities mentioned herein or are entitled to any financial interests in relation thereto. “

投资涉及风险,有可能损失投资本金。你应该咨询专业人士,就本身的投资经验,财务状况,个人目标及风险取向,以提供投资意见。各类产品的风立,请参阅本公司网页http://www.phillip.com.hk「风险披露声明」。

辉立(或其雇员)可能持有本文所述有关的投资产品。此外,辉立(或任何附属公司)随时可能替向报告内容所述及的公司提供服务,招揽或业务往来。

以上资料为辉立拥有并受版权及知识产法保护。除非事先得到辉立明确书面批准,否则不应复制,散播或发布。