-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Stock Borrowing & Lending

Stock Borrowing & Lending allows you to boost your opportunities by “short selling” for a longer duration and potentially benefit even if the stock market is going through a downward trend. Shorting is a classic strategy to potentially benefit when the momentum of stocks or overall trend of the market is declining. Short positions are taken not only on simple speculative bets but can also be used to execute trading strategies such as rights arbitrage, pairs trading and index arbitrage. Essentially, short positions are covered by SBL through the use of the borrowed securities to settle an outright sale.

| Available Short Sell Stock List | |||||

|---|---|---|---|---|---|

| Stock Code | Stock Name | Stock Code | Stock Name | Stock Code | Stock Name |

| 2 | CLP HOLDINGS | 662 | Asia Financial | 1361 | 361 DEGREES |

| 4 | WHARF HOLDINGS | 688 | CHINA OVERSEAS | 1398 | ICBC |

| 5 | HSBC HOLDINGS | 696 | TRAVELSKY TECH | 1898 | CHINA COAL |

| 17 | NEW WORLD DEV | 700 | TENCENT | 1928 | SANDS CHINA LTD |

| 20 | WHEELOCK | 728 | CHINA TELECOM | 1988 | MINSHENG BANK |

| 27 | GALAXY ENT | 751 | SKYWORTHDIGITAL | 2007 | COUNTRY GARDEN |

| 66 | MTR CORPORATION | 753 | AIR CHINA | 2318 | PING AN |

| 83 | SINO LAND | 762 | CHINA UNICOM | 2328 | PICC P&C |

| 144 | CHINA MER HOLD | 811 | XINHUA WINSHARE | 2343 | PACIFIC BASIN |

| 151 | WANT WANT CHINA | 813 | SHIMAO PROPERTY | 2388 | BOC HONG KONG |

| 173 | K. WAH INT'L | 855 | CHINA WATER | 2600 | CHALCO |

| 175 | GEELY AUTO | 857 | PETROCHINA | 2628 | CHINA LIFE |

| 189 | DONGYUE GROUP | 882 | TIANJIN DEV | 2689 | ND PAPER |

| 242 | SHUN TAK HOLD | 883 | CNOOC | 2777 | R&F PROPERTIES |

| 267 | CITIC PACIFIC | 939 | CCB | 2800 | TRACKER FUND* |

| 272 | SHUI ON LAND | 941 | CHINA MOBILE | 2823 | X ISHARES A50* |

| 308 | CHINA TRAVEL HK | 991 | DATANG POWER | 3323 | CNBM |

| 315 | SMARTONE TELE | 1038 | CKI HOLDINGS | 3328 | BANKCOMM |

| 330 | ESPRIT HOLDINGS | 1088 | CHINA SHENHUA | 3333 | EVERGRANDE |

| 358 | JIANGXI COPPER | 1109 | CHINA RES LAND | 3383 | AGILE PROPERTY |

| 363 | SHANGHAI IND H | 1114 | BRILLIANCE CHI | 3818 | CHINA DONGXIANG |

| 386 | SINOPEC CORP | 1171 | YANZHOU COAL | 3933 | UNITED LAB |

| 388 | HKEX | 1186 | CHINA RAIL CONS | 3968 | CM BANK |

| 390 | CHINA RAILWAY | 1199 | COSCO PACIFIC | 3988 | BANK OF CHINA |

| 546 | FUFENG GROUP | 1200 | MIDLAND HOLDING | 3993 | CMOC |

| 552 | CHINACOMSERVICE | 1211 | BYD COMPANY | 6030 | CITIC SEC |

| 590 | LUK FOOK HOLD | 1288 | ABC | ||

| 656 | FOSUN INTL | 1299 | AIA | ||

| *Settle at RMB | |||||

| A-Share ETF: | |||||

|---|---|---|---|---|---|

| 2822 | CSOP A50 ETF | 3188 | CAM CSI300 | *83188 | CAM CSI300-R |

| 2823 | X ISHARES A50 | *82822 | CSOP A50 ETF-R | ||

Welcome to call us at 22776622, SBL Department for the short sell stocks

Designated Securities Eligible for Short Selling:

https://www.hkex.com.hk/eng/market/sec_tradinfo/ds20191209.htm

(The Company does not guarantee the accuracy of the data sources)

Stock Yield Enhancement Plan

What is "Stock Yield Enhancement Plan"?

You can now participate in the Stock Yield Enhancement Plan, which allows Phillip Securities to borrow US stocks from your stock account and lend them to counterparties who wish to engage in short selling and are willing to pay borrowing interest. As a participant, you will receive collateral (in cash) and daily borrowing interest for the stocks lent out. The borrowing interest will be determined based on the prevailing market interest rates. During the borrowing period, you are free to trade the borrowed US stocks at any time without any restrictions.

Note: Phillip Securities will automatically borrow stocks from your account based on market demand without providing separate notification.

While Phillip borrows your stocks, the collateral we provide will be held in a third-party trust institution, and you will not be allowed to withdraw or transfer these funds at any time. It is only for safe keeping purpose, for more information please refer to the terms and conditions. You can also check the borrowing interest you receive on the daily statement.

Example:

Let's assume the closing price of ABC stock is $100, and you lend 5,000 shares of this stock. If Phillip receives borrowing interest from the counterparty at 10%, Phillip will pay you daily borrowing interest as follows: (100 * 5000 * 5%) / 360 = $69.

Note: The profits will be split 50% each between Phillip and the customer.

How to apply for or withdraw from the Stock Yield Enhancemen Plan?

Please contact your broker colleagues or call the Securities Borrowing and Short Selling Department at: 2277-6622.

Promotion

Stay tuned for exciting promotions!

Client Agreement

Please press here to view the relevant agreements

You can now participate in the Stock Yield Enhancement Plan, which allows Phillip Securities to borrow US stocks from your stock account and lend them to counterparties who wish to engage in short selling and are willing to pay borrowing interest. As a participant, you will receive collateral (in cash) and daily borrowing interest for the stocks lent out. The borrowing interest will be determined based on the prevailing market interest rates. During the borrowing period, you are free to trade the borrowed US stocks at any time without any restrictions.

Note: Phillip Securities will automatically borrow stocks from your account based on market demand without providing separate notification.

While Phillip borrows your stocks, the collateral we provide will be held in a third-party trust institution, and you will not be allowed to withdraw or transfer these funds at any time. It is only for safe keeping purpose, for more information please refer to the terms and conditions. You can also check the borrowing interest you receive on the daily statement.

Example:

Let's assume the closing price of ABC stock is $100, and you lend 5,000 shares of this stock. If Phillip receives borrowing interest from the counterparty at 10%, Phillip will pay you daily borrowing interest as follows: (100 * 5000 * 5%) / 360 = $69.

Note: The profits will be split 50% each between Phillip and the customer.

How to apply for or withdraw from the Stock Yield Enhancemen Plan?

Please contact your broker colleagues or call the Securities Borrowing and Short Selling Department at: 2277-6622.

Promotion

Stay tuned for exciting promotions!

Client Agreement

Please press here to view the relevant agreements

Note: Stock Yield Enhancement Plan only provides electronic form of daily statement and monthly statement. For enquiry please contact your account executive or Phillip SBL department.

| Buy PUT derivative Warrant | SBL – short sell | |

|---|---|---|

| Liquidity | Single liquidity provider/ AMS (Automatic Order Matching and Execution system) | AMS (Automatic Order Matching and Execution system) |

| Bid-ask spread | Determined by liquidity provider | Usually has smaller spread size |

| Expiry | Expiry date is determined by issuer | No expiry date |

| Profit / Loss | Factors involved stock price, volatility, outstanding quantity etc. | Stock price |

Stock Borrowing

- Open SBL account in Phillip Securities (HK) Ltd

- Call 2277 6622 to check whether Phillip has the stock that you want to short sell

Short Sell

- If we have the stock you want to short sell, you can place short sell order through our dealers.

- For example, successfully short sold 10 lots of Hang Seng Bank (00011.HK) with selling price $100.

- Client has to deposit $25,000 into securities account for collateral at T day (transaction day).

($100 x 10 lots x 100 shares per lot x 25% = $25,000) - At T+2 day, Phillip transfers $125,000 from client’s stock account to SBL account.

($100,000 is principal of short sell)

Maintenance margin – example 1

| Maintenance margin: 115% of market value at the time | |

| If price of Hang Seng Bank (00011.HK) is $90 | |

| Margin ratio = 138% 【125,000 / 90*1,000】 | |

| No need to deposit for margin | |

| Moreover, client can withdraw part of collateral to stock account. Available amount is $12,500 【125,000-$90x1000x1.25】 |

Maintenance margin – example 2

| Maintenance margin: 115% of market value at the time | |

| If price of Hang Seng Bank rises to $110 | |

| Margin ratio =114%【125,000 / (110*1000)】 < 115% | |

| Required to deposit | |

| Required to be deposited margin:$12,500 【1.25*(110*1000) - 125,000】 |

Stock Return

- Hang Seng Bank drops down to $92, client decides to buy back and return stock.

- Client can buy stock through online or your Account Executive normally. Inform us after buy back,

otherwise the return process will not be handled. - At T+2 day of buy back stock, Phillip return the $125,000 margin to client’s stock account, and withdraw the stock for return.

- Loan fee will be deducted from stock account at return day (T+2 of buy back).

| Item | Description of fees |

|---|---|

| Stock Borrowing & Lending | |

| IRO Registration Fee | HKD270 (Charge once only) |

| Loan Fee | Depend on borrowing value and annual interest rate agreed. Minimum loan fee (Hong Kong Shares: HKD200, Shanghai-Hong Kong Stock Connect: CNY200) |

| Borrowing Value | No minimum requirement (at least one lot) |

Above charges are for reference only, there are subject to change without prior notice.

Trading:Online/Telephone

- Choosing stock for collateral, client still can’t withdraw the principal of short sell.

- If stock ex-dividends during stock borrowing, Phillip will deduct dividend from client’s stock account at book closed date.

- There has no time limit on stock borrowing, but Phillip has the right to request borrower to return stock in specific time.

- Clients with cash or margin account can open a SBL account.

For Cash Account Only

Searching for chances to increase the rate of return but exposing to relatively low risk?

If you are holding stocks for a long period, you can lend out stocks to increase the return of your portfolio.

Advantages of lending out stock:

- Increase extra return of your portfolio.

- No minimum number of lending days, so, lending out may not affect your usual trading. You can sell the stock on T+1 after you simply notified your account executive on T.

- You have no need handle any operations including interest calculation etc, which will be handled by us.

- Dividend and rights, if any, could still be received by the lender.

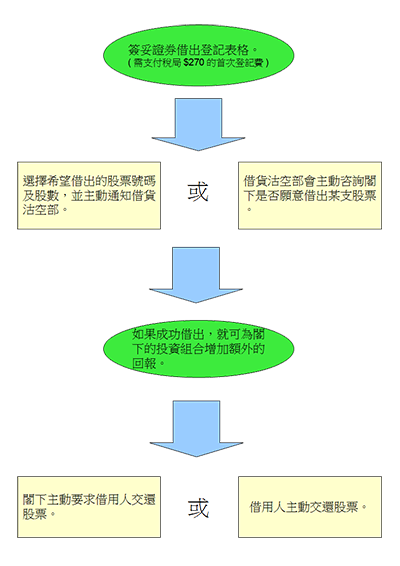

What you need to do?

Examples

If you lend out 500k BYD Co. Ltd.(1211.hk) at 5% annual interest (360days) annually on 31/1/2012 (value date) and the borrower returned to you on 7/2/2012(value date), the calculation is as follows:

| Date | Closing price | Interest for single date |

|---|---|---|

| 31/01/2012 | $24.25 | $24.25 x 500,000 x 5% / 360 = $1684.03 |

| 01/02/2012 | $23.65 | $23.65 x 500,000 x 5% / 360 = $1642.36 |

| 02/02/2012 | $24.55 | $24.55 x 500,000 x 5% / 360 = $1704.86 |

| 03/02/2012 | $24.65 | $24.65 x 500,000 x 5% / 360 = $1711.81 |

| 04/02/2012 | $24.65 | $24.65 x 500,000 x 5% / 360 = $1711.81 |

| 05/02/2012 | $24.65 | $24.65 x 500,000 x 5% / 360 = $1711.81 |

| 06/02/2012 | $24.90 | $24.90 x 500,000 x 5% / 360 = $1729.17 |

The interest will be paid at the beginning of each month and / or on the value date of the return. In this case, you will receive $1684.03 at the beginning of February, and $10211.8 and 500k shares 1211.hk on 7/2/2012.

Example 1

You wrote a short call for HSBC Holdings(0005.hk). But finally, it was assigned. You can:

- Buy the stocks immediately for settlement.

- Borrow the stock for settlement and wait for a better price to buy back and return the stock (you must have stock borrowing and lending account)

Example 2

You bought a put for HSBC Holdings(0005.hk). But today is the expiry date of the option you can:

- Roll over the option to an other period.

- Exercise the contract and borrow the stock for settlement and wait for a better price to buy back and return the stock (you must have stock borrowing and lending account)

Top of Page

|

Please contact your account executive or call us now. Stock Borrowing and Lending (SBL) Tel : (852) 2277 6622 Email : sbl@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|