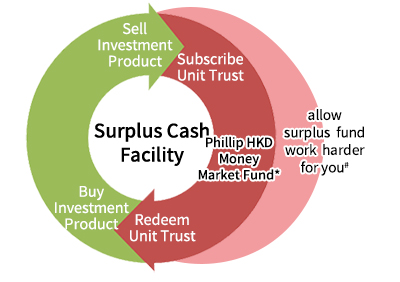

What is Surplus Cash Facility?

- A service designed to allow your surplus cash works harder for you while waiting for your next investment.

- When account balance reaches HK$2,000, the facility will automatically invest the surplus cash into Phillip HKD Money Market Fund* (the “Fund”) after reserving HK$500 for general expenses.

- The facility will automatically redeem units of the Fund for shares payment or other investment purchases.

- Client can place withdrawal instruction through POEMS.

- The Fund has been authorized by the Securities and Futures Commission in Hong Kong*.

(Security Code Generator PHK Key required

Service Features

Maximise investment opportunities with surplus cash

Client could maximise return to surplus cash in their account and seek a higher rate of return as compared to personal deposits^. Please note that the return from the Fund is not guaranteed.

High degree of liquidity

The Fund invests primarily in HKD-denominated money market instruments, short-term (less than 1 year) debt securities and short-term deposits.

Seamless payment for your shares trades and other investments

Under Surplus Cash Facility, the units can then be automatically redeemed for settlement for stock and trading. Fund can also be transferred for other investments.

No lock-in period for your surplus cash

With Surplus Cash Facility, withdrawal and fund transfer instruction could be completed as soon as on the date of instruction.

No sales charges or administration fees

Surplus Cash Facility is a free service without extra sales charges or administration fees.

(Security Code Generator PHK KEY)required

What is Money Market Fund?

An open-ended unit trust / mutual fund that invests in short-term (less than 1-year), and low risk debt securities for liquidity.

- Investment objective is to preserve capital while providing higher yield.

- A low risk place to park your cash awaiting investment.

Why invest in Money Market Fund?

- Stability: Money Market Funds are generally less volatile and more defensive to market fluctuations than many other types of investments.

- Liquidity: Money Market Funds usually provide daily dealing. Assets are generally available on the same/by the next business day.

- Diversification: Money Market Funds invest in a pool of high quality, short duration debt securities which may reduce concentration risk, credit risk and interest rate risk of the portfolio.

- Professionalism: A convenient gateway to access professional capital management, rigorous credit and risk analysis and market research expertise of the fund manager.

- Yield: Money Market Funds aim to provide more competitive current income than cash and normal saving deposits.

- Flexibility: Money Market Funds generally have relatively low initial investment requirement and do not have minimum holding period.

(Security Code Generator PHK KEY required)

Last Update:June 23, 2017

Terms and Conditions

DECLARATION BY APPLICANT

- I/We wish to subscribe to the Fund with all surplus funds in my/our account according to the prescribed thresholds (please refer to section 6 “Client Standing Authority on Facility”, point 1 in this form for details) as they are mandated in the Standing Authority.

- I/We fully understand that Fund units are not bank deposits and are not endorsed or guaranteed by, and do not constitute obligation of the Company or its affiliates.

- I/We acknowledge that I/we have been given a copy of this form together with all associated documents such as the Explanatory Memorandum and Product Key Facts Statement.

- I/We have read all offering documents including, without limitation, the relevant Explanatory Memorandum, Product Key Facts Statement and annual report and agree to the terms set out in such offering documents. I/We am/are fully aware of and understand the terms set out in the offering documents, including, without limitation, the risks of investing in the Fund. The above are provided in a language of my/our choice (English or Chinese). I/We have been invited to read them, to ask questions and take independent advice if I/we wish. I/We agree to the contents as set out in such documents, and I/we hereby declare that I am/we are fully responsible for bearing the risk of loss involved in investing in the Fund.

- I/We fully understand that the offering documents are not intended to provide, and must not be relied upon for, tax, legal or accounting advice, a credit or other evaluation of the Fund nor as assurance or guarantee as to the expected return (if any) of the Fund. I/We should consult my/our tax, legal, accounting, investment, financial and/or other advisors.

- I/We certify that I am/we are not prohibited from purchasing or holding units, and I am/ we are acting on behalf of any person or entity who is prohibited from purchasing or holding units, as provided in the documents mentioned in Statement 4 above. I/We declare that I am/we are not citizen(s) or resident(s) of the countries set out in the documents referred to in Statement 4 above who are not permitted to invest in the Fund. I/We undertake to inform the Company immediately if I/we become citizen(s) or resident(s) of these countries, in which circumstances I/we may be obliged to redeem the units of the Fund.

- I/We fully understand that the past performance of the Fund is not a guarantee of its future performance and that the value of units of the Fund may go down as well as up. Although the fund manager may seek to maintain or preserve the principal value of the Fund, there can be no assurance that the Fund will be able to meet my/our objectives.

- I/We understand that any discount on service and/or handing fees will be provided by the Company on a discretionary basis only.

- I/We understand that the Company acts as my agent in the transactions. I/We understand the relevant fees, charges and expenses incurred from this instruction. I/We hereby authorise the Company to accept and retain for its own benefit any commission, rebate, reallowance, benefit and/or other advantage arising out of or in connection with the handling of the above transaction(s).

- The Company is entitled to receive a trailer fee from the fund house, up to one percent per annum of the fund value. The Fund is managed by Phillip Capital Management (HK) Limited, a subsidiary of the Company and may have an interest, relationship or arrangement that could be material and/or give rise to a conflict of interest in relation to a transaction effected with or for the Client (“Material Interest”). In such event, subject to any applicable regulations, the Client consents that in the absence of a Material Interest and disadvantage to the Client, the Company may act in any manner that it considers appropriate and the Company or any Associate may retain for its own benefit any related profit, charges, commission or other remuneration.

- I/We understand that this instruction will be conclusive and binding on me/us upon my/our placement of this instruction but is subject to final execution and acceptance by the Company

CLIENT STANDING AUTHORITY ON FACILITY

This document of authority is in respect of any surplus Hong Kong Dollar (“HKD”) in my/our cash/margin account with Phillip Securities (Hong Kong) Limited (“Company”).

The purpose of this document is to apply the Surplus Cash Facility and grant authority to the Company conduct the following:

- Transfer surplus HKD in my/our cash/margin account (“Account”) to Phillip HKD Money Market Fund (“Fund”) when I/we have surplus of HKD 2,000 or more in my/our Account. All surplus funds shall be transferred except HKD 500 as a balance for any fees and charges.

- Redeem the Fund in my/our Account for the purposes of executing trade settlements, the payment of trading fees and charges and/or the payment of any actions as mandated by me/us when there is insufficient cash balance in my/our Account such that a balance of HKD 500 is restored to my/our Account.

- Redeem the Fund in my/our Account for the purposes of settling any shortfall incurred such that a balance of HKD 500 is restored to my/our Account.

With regard to authorizing the transfer of surplus HKD in my Account with the Company, I/we understand that:

- The application to the Surplus Cash Facility is subject to the approval of the Company.

- Surplus HKD (above the prescribed level) in Account applied to the Surplus Cash Facility of the Company will be automatically transferred into the Fund. (c) Possible concentration risk may arise if a 30% or more of my/our total assets are invested in the Fund.

- The Fund is a SFC authorized fund which only invests in/with investment grade instruments/counter parties.

- The Fund will be redeemed automatically for settlement of any local and foreign stock trading, withdrawals, transfers, payments and charges denominated in HKD from the designated local stock account.

- The facility is applicable to foreign stock trading only in situations where the Client gives instructions to settle such trades in HKD.

- The Surplus Cash Facility is applicable to the Account designated on the application form only.

- The Surplus Cash Facility operates under a prescribed settlement time frame. Cash withdrawal instructions issued after the daily cut off time as prescribed on www.poems.com.hk will be executed on the next trading day.

- Any instructions given by me/us regarding my/our Account may cause a shortfall to arise in said Account and I/we are liable for all interest payments that result from such a shortfall. A shortfall may arise as a result of a range of different situations. They include but are not limited to corporate actions such as rights subscription, fund transfer between accounts requested after daily cut off time, etc.

- Any redemption of units in the Fund under the Surplus Cash Facility will be credited into my/our Account number as listed above.

This authority is valid for a period of 12 months from the date of signing this document. It may be revoked by giving the Company written notice addressed to the Customer Service Department. Such notice shall take effect upon the expiry of two weeks from the date of the Company’s actual receipt of such notice. I/We understand that this authority shall be deemed to be renewed on a continuing basis without my/our written consent if the Company issues me/us a written reminder at least 14 days prior to the expiry date of this authority, and I/we do not object to such deemed renewal before such expiry date.

Service Details

What is Surplus Cash Facility?

“Surplus Cash Facility” is a cash management service. It allows your excess funds to work harder for you while you wait for your next investment. The idle HK dollar funds in your securities account will automatically be transferred to “Phillip Hong Kong Dollar Money Market Fund*” in search of extra returns.。

This service automatically redeems fund needed for trade settlement, cash withdrawal and transfer, fees payment in Hong Kong Dollar under the securities account.

What kinds of clients are best suited to use the “Surplus Cash Facility” service?

This service suits clients who hold idle funds in their cash or margin accounts and look for high liquidity and low risk.

What are the service charges for “Surplus Cash Facility”?

“Surplus Cash Facility” is free of charge. There’s no commission or service fee.

Does the "Surplus Cash Facility" service offer guaranteed return?

Income of the Hong Kong Dollar Money Market Fund is not guaranteed, “Surplus Cash Facility” is not equivalent to bank deposits. Investor should read the fund fact sheet and related documents in order to understand the underlying risk.

Service Application

How to apply for the "Surplus Cash Facility"?

You need to:

1. Open a securities account with Phillip Securities (HK) Ltd

2. Apply for the E-statement service

3. Complete a Risk Profile Questionnaire

4. Sign the “Surplus Cash Facility” Application Form and Client Standing Authority on Facility Form.

After submitting the application, how long does it take to activate the service?

“Surplus Cash Facility” service will be activated in two business days after the related documents are well received.

If clients under joint account wish to apply for the Surplus Cash Facility service, is it acceptable only one of the account holders signs the “Surplus Cash Facility” application form and the Client Standing Authority form?

No, all joint-account holders must sign the applicable forms.

Can authorized person sign the "Surplus Cash Facility" Application Forms for the clients?

No.

Can CIES clients apply for “Surplus Cash Facility” service?

No, because the Phillip Hong Kong Dollar Money Market Fund is not included in the List of Eligible Collective Investment Schemes under CIES.

If a CIES client holds an account outside of the CIES program, is that account eligible for the application of “Surplus Cash Facility” service?

Yes.

How to terminate the service?

Clients can terminate the service by completing the “Account Particulars Amendment Form” and notifying us.

Fund Transfer

Is there a minimum transfer amount for “Surplus Cash Facility” service?

Yes. When the idle HK dollar fund in securities account is HKD2,000 or above, all but HKD500 of the surplus funds will be transferred to the Phillip HKD Money Market Fund.

If there is a balance due in the account, can “Surplus Cash Facility” transfer funds?

When the securities account has any HKD balance due, “Surplus Cash Facility” will automatically transfer funds for such payments.

If there is a balance due in foreign currency or in accounts other than the Hong Kong securities account, clients can notify their sales representatives to transfer funds for such payments.

For more information, please refer to FAQ: "If clients need to transfer funds through “Surplus Cash Facilities” to “Futures” / “Stock Options” / “Forex” / “Bullion” accounts for transactions on the same day, when should clients inform Phillip of such transfer instruction?"

Why does “Surplus Cash Facility” service transfer more funds than the amount needed for payments or transfer?

Any transaction, payments or transfer occurred in HK Securities Account would debit the cash balance in the account first. If the cash balance is not sufficient to settle the amount, "Surplus Cash Facility" will automatically transfer fund to the HK Securities Account. Also, when “Surplus Cash Facility” transfers funds for transactions, payments or transfer, it will transfer an additional HKD500 (it will transfer the whole amount if the balance is less than HKD500) to ensure that the securities account reserves sufficient cash.

Please refer the following table:

| Examples | HK Securities Account Balance before Settlement/Payment | Settlement/Payment Amount | Debit Balance in HK Securities Account | “Surplus Cash Facility” related fund’s balance | “Surplus Cash Facility” transfer amount (Account Debit Balance+Reserve Cash) |

HK Securities Account Balance after Settlement/Payment |

| 1 | HK$ 500 | HK$ 1000 | HK$ 500 | HK$ 1000 | HK$ 1000 (HK$ 500+HK$500) |

HK$ 500 |

| 2 | HK$ 200 | HK$ 1000 | HK$ 800 | HK$ 2000 | HK$ 1300 (HK$ 800+HK$500) |

HK$ 500 |

| 3 | HK$ 1500 | HK$ 2000 | HK$ 500 | HK$ 800 | HK$ 800 (HK$ 500+HK$300) |

HK$ 300 |

| Examples | HK Securities Account Balance before Settlement/Payment | Settlement/Payment Amount | Debit Balance in HK Securities Account | “Surplus Cash Facility” related fund’s balance | “Surplus Cash Facility” transfer amount (Account Debit Balance+Reserve Cash) |

HK Securities Account Balance after Settlement/Payment |

| 4 | HK$ 500 | HK$ 400 | HK$0 | HK$1000 | HK$ 0 | HK$ 100 |

When is the instruction deadline to withdraw cash on the same day through “Surplus Cash Facility”?

Withdrawal request have to be successfully submitted to sales representatives or POEMS before 09:20 (per our system time) on a transaction date.

Does “Surplus Cash Facility” have a maximum transfer amount?

Can clients set a maximum transfer amount limit on “Surplus Cash Facility”?

No. When the idle HK dollar fund in securities account is HKD2,000 or above, all but HKD500 of the surplus funds will be transferred to the Phillip HKD Money Market Fund.

If clients need to transfer funds through “Surplus Cash Facilities” to “Futures” / “Stock Options” / “Forex” / “Bullion” accounts for transactions on the same day, when should clients inform Phillip of such transfer instruction?

Clients should inform their sales representative before 9:20 (per our system time) of such transfer instruction for it to be completed on the same day.

What is the impact if transfer instructions are given after 09:20?

For transfer instructions submitted between 09:20 – 15:20, Phillip will first debit the amount from HK securities account and redeem the fund units on the next trading day. Interests may be incurred for at least one overnight. Please refer to the below table for further details:

| Transfer Instruction Time | Complete transfer from HK Securities Account | Will interest incur in HK Securities Account? |

| 00:00 - 09:20 | Same Day | No |

| 09:21 – 15:30 | Same Day | Yes, at least interest for one overnight |

| 15:31 - 23:59 | Next Trading Day | No |

How do I check “Surplus Cash Facility” related fund’s balance?

Clients can check their balance on their e-statement.

In addition, clients can enquire about balance of last trading day via "Position>>Balance BF" under POEMS and "Position>>Previous Balance" under SATS platforms.

Product Transactions

Will clients’ purchasing power be affected after clients’ surplus cash has been transferred to the Fund?

No. Clients of Phillip HKD Money Market Fund will have the same purchasing power as if they are holding the same amount in cash.

Will “Surplus Cash Facility” service transfer funds to settle transactions of foreign stocks?

Yes, provided that the clients selected HKD as the settlement currency of such transactions.

Will “Surplus Cash Facility” automatically transfer fund to “Futures” / “Stock Options” / “Forex” / “Bullion” accounts?

No. Clients must inform their sales representatives for transfer request to these accounts.

IPO Subscription

If clients apply for IPO in cash, will the application be rejected due to insufficient balance in the securities account given surplus cash in the account has been transferred to the fund through “Surplus Cash Facility”?

No. If clients apply for IPO in cash, “Surplus Cash Facility” will automatically redeem fund units to settle the application amount on payment date.

If clients apply IPO on margin, will the application be rejected due to insufficient balance in the securities account given surplus cash in the account has been transferred to the fund through “Surplus Cash Facility”?

No. If clients apply IPO on margin, “Surplus Cash Facility” will automatically redeem fund units to settle the margin amount on payment date.

After announcement of the IPO allotment result, will “Surplus Cash Facility” automatically transfer funds to settle the outstanding amount if the application is made on margin?

Yes. We will redeem fund units according to the maximum allocation amount of shares published by HKEX to ensure there are sufficient funds transferred to clients’ accounts for settlement.

*“Phillip HKD Money Market Fund” has been authorized by the Securities and Futures Commission in Hong Kong (the "SFC"). SFC authorization does not imply official recommendation. This page is for informational purposes only and should not be interpreted as an offer or solicitation to buy or sell any investment products, and does not constitute any form of investment advice. This document has not been reviewed by the SFC. Please refer to the Risk Disclosures Statement of Phillip HKD Money Market Fund.

#Investment involves risks. Please refer to the Risk Disclosures Statement on our website at www.poems.com.hk.