-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Grade Based MarginNEW

Introduction

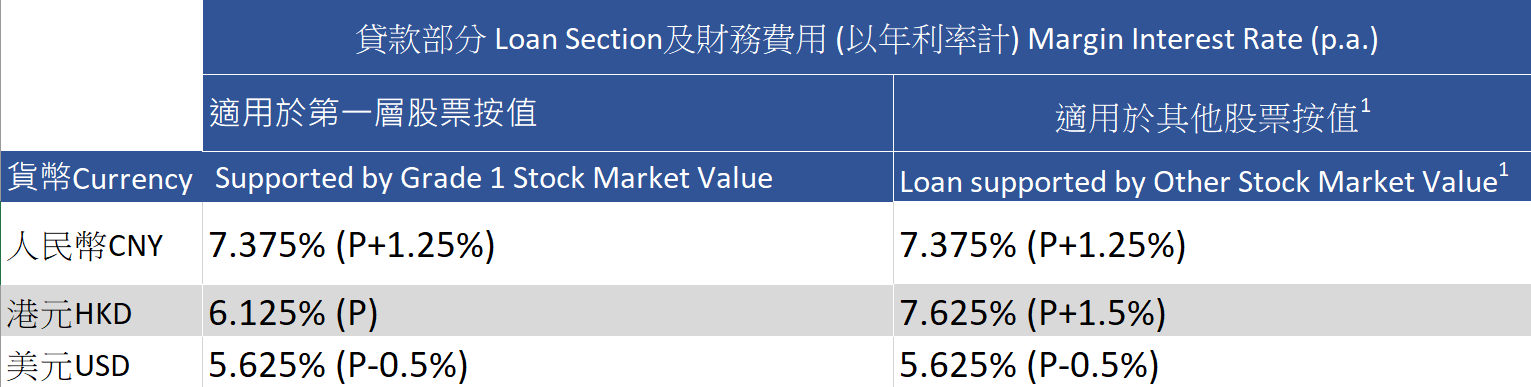

Interest rate and the interest calculation in Grade-Based Margin financing is based on the stock ranking. There are 3 layers of outstanding based on stock quality and margin value* in Grade-Based Margin financing.

More Grade 1 stock in securities portfolio , lower interest rate it is. ! The calculation of interest rate is as follows:

Cat in Maze, TVC of margin financing service, Phillip HK, 2024

YouTube video(Mandarin)

Table Footnotes:

P refers to the Prime rate of Standard Chartered Bank.

Other stock refers to all stocks that are not in Grade 1 Stock List.

Call for Deposit interest rate for Chinese Yuan Renminbi (CNY) is 7.375% (P+1.25%) p.a.

Call for Deposit interest rate for Hong Kong Dollar (HKD) is 14.625% (P+8.500%) p.a.

Call for Deposit interest rate for United States Dollar (USD) is 11.125% (P+5%) p.a.

For introduction and margin cost calculation, please click Graded-based Margin GOr margin rates of other currencies, please visit Margin Rates

Footnote 1: The above grade-based interest rate will be based on the effective rate which is subject to the latest Hong Kong Dollar Prime (P) rate of Standard Chartered Bank.

Footnote 2: The flat interest rate for non grade-based margin account is P(HKD Prime rate of Standard Chartered Bank) + 3%.

*The margin ratio of stock is for reference only, which is subjected to change as determined by both the market and specific company factor. The company deserves the right to provide a different ratio to client based on his account situation.

Clients must submit supporting documentation to the Company to confirm that the depository payment is from his/her own bank account. Acceptable documentation include, but is not limited to, bank statements, cheque images, and online banking screenshots. The deposit will be credited to the Client account on the day that supporting documentation is provided. Until the supporting documentation is submitted, the deposit will not be treated as “credited”. The daily cut-off time for collecting the supporting documentation is 4:00 p.m., any supporting documentation received after 4:00 p.m. will be deemed to be received on next working day. Clients will be liable for any relevant interest, commission, fines and other charges incurred as a result of not being "credited".

Introduction

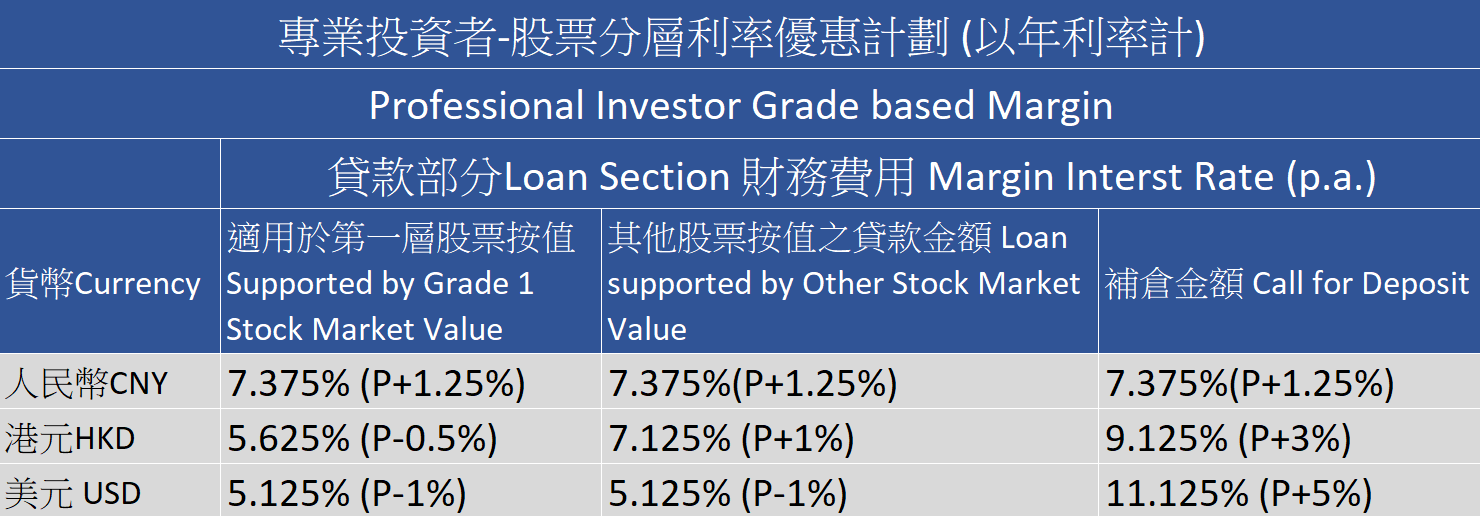

The interest rate and the interest calculation in Professional Investor Grade-Based Margin (“PI GBM”) financing are calculated based on the grading of each stock in your portfolio.

By being a Professional Investor, you can join our Professional Investor Grade-Based (“PI GBM”) Financing.

Higher proportion of Grade 1 Stock in securities portfolio, lower interest rate!

The margin financing rate of the portion of the Grade 1 Stock holding over HKD $1,000,000 can be reduced to as low as *P-1.5%.

Complete the form and submit it to your account executive to register as a Professional Investor with us today.

The calculation of interest rate is as follows:

Footnote 1: The above grade-based interest rate will be based on the effective rate which is subject to the latest Hong Kong Dollar Prime (P) rate of Standard Chartered Bank.

Footnote 2: The flat interest rate for non grade-based margin account is P(HKD Prime rate of Standard Chartered Bank) + 3%.

*The margin ratio of stock is for reference only, which is subjected to change as determined by both the market and specific company factor. The company deserves the right to provide a different ratio to client based on his account situation.

Clients must submit supporting documentation to the Company to confirm that the depository payment is from his/her own bank account. Acceptable documentation include, but is not limited to, bank statements, cheque images, and online banking screenshots. The deposit will be credited to the Client account on the day that supporting documentation is provided. Until the supporting documentation is submitted, the deposit will not be treated as “credited”. The daily cut-off time for collecting the supporting documentation is 4:00 p.m., any supporting documentation received after 4:00 p.m. will be deemed to be received on next working day. Clients will be liable for any relevant interest, commission, fines and other charges incurred as a result of not being "credited".

Grade 1 Stock List

| Stock Code | Market | Stock Name | Margin Ratio |

|---|---|---|---|

| 1 | HK | CKH HOLDINGS | 0.8 |

| 2 | HK | CLP HOLDINGS | 0.85 |

| 3 | HK | HK & CHINA GAS | 0.85 |

| 4 | HK | WHARF HOLDINGS | 0.7 |

| 5 | HK | HSBC HOLDINGS | 0.8 |

| 6 | HK | POWER ASSETS | 0.85 |

| 11 | HK | HANG SENG BANK | 0.85 |

| 12 | HK | HENDERSON LAND | 0.8 |

| 16 | HK | SHK PPT | 0.8 |

| 17 | HK | NEW WORLD DEV | 0.8 |

| 20 | HK | SENSETIME-W | 0.6 |

| 23 | HK | BANK OF E ASIA | 0.7 |

| 27 | HK | GALAXY ENT | 0.7 |

| 66 | HK | MTR CORPORATION | 0.85 |

| 83 | HK | SINO LAND | 0.8 |

| 101 | HK | HANG LUNG PPT | 0.8 |

| 123 | HK | YUEXIU PROPERTY | 0.6 |

| 135 | HK | KUNLUN ENERGY | 0.7 |

| 144 | HK | CHINA MER PORT | 0.8 |

| 151 | HK | WANT WANT CHINA | 0.8 |

| 168 | HK | TSINGTAO BREW | 0.6 |

| 175 | HK | GEELY AUTO | 0.8 |

| 241 | HK | ALI HEALTH | 0.6 |

| 257 | HK | EB ENVIRONMENT | 0.7 |

| 267 | HK | CITIC | 0.8 |

| 268 | HK | KINGDEE INT'L | 0.6 |

| 270 | HK | GUANGDONG INV | 0.7 |

| 285 | HK | BYD ELECTRONIC | 0.6 |

| 288 | HK | WH GROUP | 0.7 |

| 291 | HK | CRES BEER-500 | 0.7 |

| 316 | HK | OOIL | 0.6 |

| 322 | HK | TINGYI | 0.7 |

| 371 | HK | BJ ENT WATER | 0.7 |

| 384 | HK | CHINA GAS HOLD | 0.7 |

| 386 | HK | SINOPEC CORP | 0.8 |

| 388 | HK | HKEX | 0.8 |

| 392 | HK | BEIJING ENT | 0.8 |

| 486 | HK | RUSAL | 0.5 |

| 570 | HK | TRAD CHI MED | 0.6 |

| 586 | HK | CONCH VENTURE | 0.6 |

| 656 | HK | FOSUN INTL | 0.7 |

| 669 | HK | TECHTRONIC IND | 0.8 |

| 688 | HK | CHINA OVERSEAS | 0.8 |

| 700 | HK | TENCENT | 0.8 |

| 728 | HK | CHINA TELECOM | 0.8 |

| 762 | HK | CHINA UNICOM | 0.8 |

| 772 | HK | CHINA LIT | 0.6 |

| 788 | HK | CHINA TOWER | 0.7 |

| 817 | HK | CHINA JINMAO | 0.3 |

| 823 | HK | LINK REIT | 0.8 |

| 836 | HK | CHINA RES POWER | 0.7 |

| 857 | HK | PETROCHINA | 0.8 |

| 868 | HK | XINYI GLASS | 0.6 |

| 881 | HK | ZHONGSHENG HLDG | 0.6 |

| 883 | HK | CNOOC | 0.8 |

| 914 | HK | CONCH CEMENT | 0.7 |

| 916 | HK | CHINA LONGYUAN | 0.7 |

| 939 | HK | CCB | 0.8 |

| 941 | HK | CHINA MOBILE | 0.8 |

| 960 | HK | LONGFOR GROUP | 0.6 |

| 966 | HK | CHINA TAIPING | 0.7 |

| 968 | HK | XINYI SOLAR | 0.8 |

| 981 | HK | SMIC | 0.7 |

| 992 | HK | LENOVO GROUP | 0.8 |

| 998 | HK | CITIC BANK | 0.8 |

| 1024 | HK | KUAISHOU-W | 0.7 |

| 1038 | HK | CKI HOLDINGS | 0.8 |

| 1044 | HK | HENGAN INT'L | 0.8 |

| 1066 | HK | WEIGAO GROUP | 0.6 |

| 1088 | HK | CHINA SHENHUA | 0.8 |

| 1093 | HK | CSPC PHARMA | 0.6 |

| 1099 | HK | SINOPHARM | 0.7 |

| 1109 | HK | CHINA RES LAND | 0.8 |

| 1113 | HK | CK ASSET | 0.8 |

| 1114 | HK | BRILLIANCE CHI | 0.7 |

| 1171 | HK | YANKUANG ENERGY | 0.7 |

| 1177 | HK | SINO BIOPHARM | 0.6 |

| 1179 | HK | HWORLD-S | 0.4 |

| 1193 | HK | CHINA RES GAS | 0.6 |

| 1209 | HK | CHINA RES MIXC | 0.6 |

| 1211 | HK | BYD COMPANY | 0.8 |

| 1288 | HK | ABC | 0.8 |

| 1299 | HK | AIA | 0.8 |

| 1308 | HK | SITC | 0.5 |

| 1313 | HK | CR BLDG MAT TEC | 0.7 |

| 1347 | HK | HUA HONG SEMI | 0.6 |

| 1378 | HK | CHINAHONGQIAO | 0.7 |

| 1398 | HK | ICBC | 0.8 |

| 1658 | HK | PSBC | 0.7 |

| 1698 | HK | TME-SW | 0.5 |

| 1772 | HK | GANFENGLITHIUM | 0.6 |

| 1801 | HK | INNOVENT BIO | 0.5 |

| 1810 | HK | XIAOMI-W | 0.8 |

| 1821 | HK | ESR | 0.6 |

| 1876 | HK | BUD APAC | 0.7 |

| 1913 | HK | PRADA | 0.6 |

| 1919 | HK | COSCO SHIP HOLD | 0.6 |

| 1928 | HK | SANDS CHINA LTD | 0.6 |

| 1929 | HK | CHOW TAI FOOK | 0.7 |

| 1972 | HK | SWIREPROPERTIES | 0.7 |

| 1997 | HK | WHARF REIC | 0.7 |

| 2015 | HK | LI AUTO-W | 0.6 |

| 2020 | HK | ANTA SPORTS | 0.8 |

| 2057 | HK | ZTO EXPRESS-W | 0.7 |

| 2202 | HK | CHINA VANKE | 0.6 |

| 2269 | HK | WUXI BIO | 0.6 |

| 2313 | HK | SHENZHOU INTL | 0.7 |

| 2318 | HK | PING AN | 0.8 |

| 2319 | HK | MENGNIU DAIRY | 0.8 |

| 2328 | HK | PICC P&C | 0.7 |

| 2331 | HK | LI NING | 0.7 |

| 2333 | HK | GWMOTOR | 0.7 |

| 2359 | HK | WUXI APPTEC | 0.6 |

| 2378 | HK | PRU | 0.6 |

| 2380 | HK | CHINA POWER | 0.6 |

| 2382 | HK | SUNNY OPTICAL | 0.7 |

| 2388 | HK | BOC HONG KONG | 0.8 |

| 2423 | HK | BEKE-W | 0.3 |

| 2601 | HK | CPIC | 0.7 |

| 2618 | HK | JD LOGISTICS | 0.6 |

| 2628 | HK | CHINA LIFE | 0.8 |

| 2638 | HK | HKELECTRIC-SS | 0.8 |

| 2688 | HK | ENN ENERGY | 0.7 |

| 2800 | HK | TRACKER FUND | 0.8 |

| 2822 | HK | CSOP A50 ETF | 0.8 |

| 2823 | HK | ISHARES A50 | 0.8 |

| 2828 | HK | HSCEI ETF | 0.8 |

| 2839 | HK | CAM MSCI A50 | 0.8 |

| 2888 | HK | STANCHART | 0.7 |

| 2899 | HK | ZIJIN MINING | 0.6 |

| 3032 | HK | HSTECH ETF | 0.7 |

| 3033 | HK | CSOP HS TECH | 0.7 |

| 3067 | HK | ISHARESHSTECH | 0.7 |

| 3088 | HK | CAM HS TECH | 0.7 |

| 3188 | HK | CAM CSI300 | 0.8 |

| 3311 | HK | CHINA STATE CON | 0.7 |

| 3320 | HK | CHINARES PHARMA | 0.6 |

| 3323 | HK | CNBM | 0.6 |

| 3328 | HK | BANKCOMM | 0.8 |

| 3690 | HK | MEITUAN-W | 0.8 |

| 3692 | HK | HANSOH PHARMA | 0.5 |

| 3799 | HK | DALI FOODS | 0.5 |

| 3800 | HK | GCL TECH | 0.7 |

| 3808 | HK | SINOTRUK | 0.6 |

| 3888 | HK | KINGSOFT | 0.6 |

| 3968 | HK | CM BANK | 0.8 |

| 3988 | HK | BANK OF CHINA | 0.8 |

| 4239 | HK | HKGB IBOND 2311 | 0.97 |

| 4246 | HK | HKGB IBOND 2406 | 0.97 |

| 4252 | HK | HKGB RGB 2505 | 0.97 |

| 4273 | HK | HKGB RGB 2610 | 0.97 |

| 6030 | HK | CITIC SEC | 0.7 |

| 6110 | HK | TOPSPORTS | 0.6 |

| 6160 | HK | BEIGENE | 0.6 |

| 6186 | HK | CHINA FEIHE | 0.5 |

| 6618 | HK | JD HEALTH | 0.7 |

| 6690 | HK | HAIER SMARTHOME | 0.7 |

| 6823 | HK | HKT-SS | 0.7 |

| 6862 | HK | HAIDILAO | 0.6 |

| 6969 | HK | SMOORE INTL | 0.5 |

| 9618 | HK | JD-SW | 0.8 |

| 9626 | HK | BILIBILI-W | 0.6 |

| 9633 | HK | NONGFU SPRING | 0.7 |

| 9866 | HK | NIO-SW | 0.6 |

| 9868 | HK | XPENG-W | 0.6 |

| 9888 | HK | BIDU-SW | 0.7 |

| 9961 | HK | TRIP.COM-S | 0.7 |

| 9987 | HK | YUM CHINA | 0.6 |

| 9988 | HK | BABA-SW | 0.8 |

| 9992 | HK | POP MART | 0.4 |

| 9999 | HK | NTES-S | 0.7 |

| 44007 | HK | HKGB SBOND 2509 | 0.97 |

| 44025 | HK | HKGB SBOND 2312 | 0.97 |

| 44030 | HK | HKGB SBOND 2608 | 0.97 |

| 44064 | HK | HKGB SBOND 2408 | 0.97 |

| 80011 | HK | HANGSENG BANK-R | 0.85 |

| 80016 | HK | SHK PPT-R | 0.8 |

| 80020 | HK | SENSETIME-WR | 0.6 |

| 80175 | HK | GEELY AUTO-R | 0.8 |

| 80291 | HK | CRES BEER-R-500 | 0.7 |

| 80388 | HK | HKEX-R | 0.8 |

| 80700 | HK | TENCENT-R | 0.8 |

| 80883 | HK | CNOOC-R | 0.8 |

| 80941 | HK | CHINA MOBILE-R | 0.8 |

| 80992 | HK | LENOVO GROUP-R | 0.7 |

| 81024 | HK | KUAISHOU-WR | 0.6 |

| 81211 | HK | BYD COMPANY-R | 0.8 |

| 81299 | HK | AIA-R | 0.8 |

| 81810 | HK | XIAOMI-WR | 0.8 |

| 82020 | HK | ANTA SPORTS-R | 0.8 |

| 82318 | HK | PING AN-R | 0.8 |

| 82331 | HK | LI NING-R | 0.7 |

| 82333 | HK | GWMOTOR-R | 0.7 |

| 82388 | HK | BOC HONG KONG-R | 0.8 |

| 82800 | HK | TRACKER FUND-R | 0.8 |

| 82822 | HK | CSOP A50 ETF-R | 0.8 |

| 82823 | HK | ISHARES A50-R | 0.8 |

| 82828 | HK | HSCEI ETF-R | 0.8 |

| 82839 | HK | CAM MSCI A50-R | 0.8 |

| 83188 | HK | CAM CSI300-R | 0.8 |

| 83690 | HK | MEITUAN-WR | 0.7 |

| 86618 | HK | JD HEALTH-R | 0.7 |

| 89618 | HK | JD-SWR | 0.8 |

| 89888 | HK | BIDU-SWR | 0.7 |

| 89988 | HK | BABA-SWR | 0.8 |

| 600000 | CN | SHANGHAI PUDONG DEVELOPMENT BANK | 0.7 |

| 600016 | CN | CHINA MINSHENG BANKING | 0.5 |

| 600028 | CN | CHINA PETROLEUM AND CHEMICAL | 0.7 |

| 600030 | CN | CITIC SECURITIES | 0.6 |

| 600036 | CN | CHINA MERCHANTS BANK | 0.7 |

| 600048 | CN | POLY DEVELOPMENTS AND HOLDINGS GROUP | 0.5 |

| 600104 | CN | SAIC MOTOR | 0.7 |

| 600276 | CN | JIANGSU HENGRUI MEDICINE | 0.7 |

| 600519 | CN | KWEICHOW MOUTAI | 0.7 |

| 600585 | CN | ANHUI CONCH CEMENT | 0.6 |

| 601088 | CN | CHINA SHENHUA ENERGY | 0.7 |

| 601166 | CN | INDUSTRIAL BANK | 0.7 |

| 601288 | CN | AGRICULTURAL BANK OF CHINA | 0.7 |

| 601318 | CN | PING AN INSURANCE | 0.7 |

| 601328 | CN | BANK OF COMMUNICATIONS | 0.7 |

| 601398 | CN | INDUSTRIAL AND COMMERCIAL BANK OF CHINA | 0.7 |

| 601628 | CN | CHINA LIFE INSURANCE | 0.7 |

| 601668 | CN | CHINA STATE CONSTRUCTION ENGINEERING | 0.7 |

| 601857 | CN | PETROCHINA | 0.7 |

| 601988 | CN | BANK OF CHINA | 0.7 |

Please refer to footnote 1 and footnote 2.

List of Grade 1 Unit Trust

| 代號 Code |

名稱 Fund Name |

按揭比率 Margin Ratio |

| 601028 | AB FCP I American Income Portfolio (AA MDis) HKD CASH | 0.80 |

| 340200 | Principal Global Investors Funds-Preferred Securities Fund (A Acc) USD | 0.70 |

| 380410 | JPMorgan Global Government Bond Fund (A Acc) H-USD * | 0.70 |

| 601052 | AB FCP I Short Duration Bond Portfolio (A2 Cap) EUR | 0.70 |

| 340180 | Principal Life Style Fund-Principal Hong Kong Bond Fund (Retail Acc) HKD | 0.70 |

| 320160 | BOCHK Global Bond Fund (A Acc) USD | 0.70 |

| 601051 | AB FCP I Short Duration Bond Portfolio (A2 Cap) H-EUR | 0.70 |

| 601027 | AB FCP I American Income Portfolio (AA MDis) HKD | 0.70 |

| 380500 | JPMorgan Emerging Markets Debt Fund (A Mth) USD CASH | 0.70 |

| 30680 | Allianz US Short Duration High Income Bond Fund (AM MDis) USD | 0.70 |

| 340190 | Principal Global Investors Funds-Preferred Securities Fund (A QInc) USD | 0.70 |

| 340195 | Principal Global Investors Funds-Preferred Securities Fund (A QInc) USD CASH | 0.70 |

| 601022 | AB FCP I American Income Portfolio (A2 Cap) EUR | 0.60 |

| 601062 | AB FCP I Global High Yield Portfolio (A2 Cap) EUR | 0.60 |

| 601020 | AB FCP I American Income Portfolio (A2 Cap) USD | 0.60 |

| 10290 | Aberdeen Standard SICAV I Select Euro High Yield Bond Fund (A Acc) Hedged USD | 0.60 |

| 40060 | First Sentier Asian Quality Bond Fund (I Acc) USD | 0.60 |

| 601060 | AB FCP I Global High Yield Portfolio (A2 Cap) USD | 0.60 |

| 10150 | Aberdeen Standard SICAV I Select Emerging Markets Bond Fund (A Acc) USD | 0.60 |

| 601021 | AB FCP I American Income Portfolio (A2 Cap) H-EUR | 0.60 |

| 10100 | Aberdeen Standard SICAV I Select Euro High Yield Bond Fund (A Acc) EUR | 0.60 |

| 601061 | AB FCP I Global High Yield Portfolio (A2 Cap) H-EUR | 0.60 |

| 30520 | Allianz US High Yield Fund (AT Acc) HKD | 0.60 |

| 10040 | Aberdeen Standard SICAV I Asian Local Currency Short Term Bond Fund (A Acc) USD | 0.60 |

| 50031 | Franklin Floating Rate Fund Plc (A Acc) USD | 0.60 |

| 30650 | Allianz Dynamic Asian High Yield Bond Fund (AMg MDis) USD | 0.60 |

| 30655 | Allianz Dynamic Asian High Yield Bond Fund (AMg MDis) USD CASH | 0.60 |

| 30640 | Allianz Dynamic Asian High Yield Bond Fund (AMg MDis) HKD | 0.60 |

| 30645 | Allianz Dynamic Asian High Yield Bond Fund (AMg MDis) HKD CASH | 0.60 |

| 30590 | Allianz Preferred Securities and Income (AM MDis) H2-RMB CASH | 0.60 |

| 30630 | Allianz Preferred Securities and Income (AM Mdis) H2-RMB | 0.60 |

| 30430 | Allianz US High Yield Fund (AM MDis) HKD | 0.60 |

| 30435 | Allianz US High Yield Fund (AM MDis) HKD CASH | 0.60 |

| 30445 | Allianz US High Yield Fund (AM MDis) USD | 0.60 |

| 210130 | Barings Developed and Emerging Markets High Yield Bond Fund (A QInc) USD | 0.60 |

| 380520 | JPMorgan Global High Yield Bond Fund (A Mth) USD | 0.60 |

| 30670 | Allianz US High Yield Fund (AM MDis) H2-CAD | 0.60 |

| 30440 | Allianz US High Yield Fund (AM MDis) H2-AUD | 0.60 |

| 50030 | Franklin Floating Rate Fund Plc (A MDis) USD | 0.60 |

| 50050 | Franklin High Yield Fund (A MDis) USD | 0.60 |

| 50055 | Franklin High Yield Fund (A MDis) USD CASH | 0.60 |

| 601025 | AB FCP I American Income Portfolio (AT MDis) HKD | 0.60 |

| 601026 | AB FCP I American Income Portfolio (AT MDis) HKD CASH | 0.60 |

| 601023 | AB FCP I American Income Portfolio (AT MDis) USD | 0.60 |

| 601024 | AB FCP I American Income Portfolio (AT MDis) USD CASH | 0.60 |

| 30460 | Allianz Flexi Asia Bond Fund (AM MDis) USD | 0.60 |

| 30465 | Allianz Flexi Asia Bond Fund (AM MDis) HKD | 0.60 |

| 390010 | Ping An of China SIF-RMB Bond Fund (A HYInc) RMB | 0.60 |

| 390015 | Ping An of China SIF-RMB Bond Fund (A HYInc) RMB CASH | 0.60 |

| 380530 | JPMorgan Emerging Markets Investment Grade Bond (A Mth) USD | 0.60 |

| 380535 | JPMorgan Emerging Markets Investment Grade Bond (A Mth) USD CASH | 0.60 |

| 10140 | Aberdeen Standard SICAV I Select Emerging Markets Bond Fund (A MInc) USD | 0.60 |

Footnote 1: The above grade-based interest rate will be based on the effective rate which is subject to the latest Hong Kong Dollar Prime (P) rate of Standard Chartered Bank.

Footnote 2::The flat interest rate for non grade-based margin account is P(HKD Prime rate of Standard Chartered Bank) + 3%。

*The margin ratio of stock is for reference only, which is subjected to change as determined by both the market and specific company factor. The company deserves the right to provide a different ratio to client based on his account situation.

FAQ

1. What is Grade-based margin interest plan?

Please refer to the introduction page of Grade-based Margin Interest Plan.

The grade- based margin interest rate is adjusted and based on the Prime Rate of Standard Chartered Bank from time to time. For CNY and USD Margin Interest, please click here

The grade- based margin interest rate is adjusted and based on the Prime Rate of Standard Chartered Bank from time to time. For CNY and USD Margin Interest, please click here

2. How to apply Grade-based margin interest plan instead of standard rate margin financing

Grade-based margin interest plan applies to all new margin accounts. Existing margin clients could apply the plan through their account executives or Customer Service Department, and do confirmation via POEMS pop-message after the application is approved.

3. How to apply Grade-based margin interest plan instead of standard rate margin financing?

Grade-based margin interest plan applies to all new margin accounts. Existing margin clients could apply the plan through their account executives or Customer Service Department, and do confirmation via POEMS pop-message after the application is approved.

4. How does a client know that the application of Grade-based margin interest plan is approved?

Client will receive confirmation pop-up message while log in in online trading platform POEMS if their application of Grade-based margin interest plan is approved. Please contact Customer Service Department if there is no confirmation.

5. How to check Grade 1 stock list?

Please check Grade 1 Stock list in POEMS website and it would be updated from time to time.

6. How to presume accrual interest before choosing any margin financing plan?

Please check accrual interest with your portfolio details by utilizing the calculator provided.

7. If the stock held by the client is suspended, how would the stock value be calculated?

If the stock is suspended, the stock will have no market value. There would be a margin call for deposit.

8. If outstanding excess loan limit, is there any margin call?

No, margin call would occur only if outstanding excess margin value.

9.What kind of client is suitable for Grade-based margin interest plan ?

The plan is suitable for client holding blue-chips portfolio and one's Phillip account with no margin call.

10. Do both parties of joint account need to sign on opt-in form for joining Grade-based margin interest plan?

Yes, both parties of joint account need to sign on opt-in form for joining Grade-based margin interest plan.

11. Could authorized person represent their own client to sign opt-in form to go for Grade-based margin interest plan?

No, the opt-in form must be signed by client.

12. Would Grade-based margin interest plan affect the purchase power of client?

No.

13. How to check the blend interest rate of one's account on the day?

Interest rate would be shown in the end of the month in monthly e-statement.

14. What rate of overdraft (Financing without margin value) is under the Graded-based Margin Interest Plan?

14.625% (P+8.5%)

Footnote 1: The above grade-based interest rate will be based on the effective rate which is subject to the latest Hong Kong Dollar Prime (P) rate of Standard Chartered Bank.

Footnote 2: The flat interest rate for non grade-based margin account is P(HKD Prime rate of Standard Chartered Bank) + 3%.

Footnote 1: The above grade-based interest rate will be based on the effective rate which is subject to the latest Hong Kong Dollar Prime (P) rate of Standard Chartered Bank.

Footnote 2: The flat interest rate for non grade-based margin account is P(HKD Prime rate of Standard Chartered Bank) + 3%.

Footnote 1: The above grade-based interest rate will be based on the effective rate which is subject to the latest Hong Kong Dollar Prime (P) rate of Standard Chartered Bank.

Footnote 2::The flat interest rate for non grade-based margin account is P(HKD Prime rate of Standard Chartered Bank) + 3%。

*The margin ratio of stock is for reference only, which is subjected to change as determined by both the market and specific company factor. The company deserves the right to provide a different ratio to client based on his account situation.

Clients must submit supporting documentation to the Company to confirm that the depository payment is from his/her own bank account. Acceptable documentation include, but is not limited to, bank statements, cheque images, and online banking screenshots. The deposit will be credited to the Client account on the day that supporting documentation is provided. Until the supporting documentation is submitted, the deposit will not be treated as “credited”. The daily cut-off time for collecting the supporting documentation is 4:00 p.m., any supporting documentation received after 4:00 p.m. will be deemed to be received on next working day. Clients will be liable for any relevant interest, commission, fines and other charges incurred as a result of not being ”credited”.

Top of Page

|

Customer Service Department (General Enquiries) Tel : (852) 2277 6555 Fax : (852) 2277 6008 Email : cs@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|