-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

$0 commission for Micro WTI Crude Oil Futures(100 barrels)

Enquiry: 2277 6677

E-mail: futures@phillip.com.hk

Expand|Close

Terms and Conditions

- CME Micro e-mini WTI Crude Oil Futures online commission is USD0.93 for all day trade trading and USD 1.53 for over night trading respectively, exchange levy is USD 0.27.

- Details of CME Micro E-mini Index Futures

- Free CME price feed is available for online application in POEMS, which is effective from now till further notice.

Frequently Asked Questions

Features of Crude Oil Futures

- Narrow Spread

- High Leverage

- Flexible Trading Hours

- Efficiency and Transparency

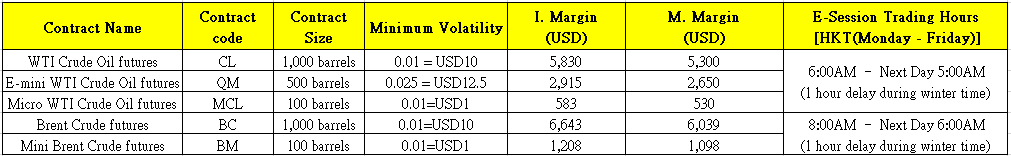

Crude Oil Futures Contract Specification

Crude Oil Settlement

There is no physical settlement WTI Crude Oil futures with Phillip, the contract must be closed on or before the last trading day.

E-mini WTI Crude Oil (QM), Micro WTI Crude Oil (MCL), Brent Crude (BC) and Mini Brent Crude (BM) are cash settlement futures.

E-mini WTI Crude Oil (QM), Micro WTI Crude Oil (MCL), Brent Crude (BC) and Mini Brent Crude (BM) are cash settlement futures.

Trading Platforms

We provide various professional futures trading platforms. In addition to the Phillip online trading platform, you can also trade through the following platforms (specify when applying):

Margin Call

When the account equity falls below the maintenance margin level, Phillip will make best effort to issue margin call via phone, email or message (if applicable) etc., requesting client to restore the account equity to initial margin level within a specified time by one of the following action:

Moreover, at volatile market conditions, Phillip reserves the right to call for margin deposit from time to time. Client should always pay attention to account position and allow sufficient equity to cover potential margin shortfall.

- deposit the margin amount; or

- transfer from other Phillip accounts; or

- close out position.

Moreover, at volatile market conditions, Phillip reserves the right to call for margin deposit from time to time. Client should always pay attention to account position and allow sufficient equity to cover potential margin shortfall.

Force Liquidation Policy

Phillip will make best effort to call client margin, however, it may not be able to contact client timely due to various reasons (including volatile market condition). If client cannot restore the account equity to initial margin level within specified time, Phillip may request client to or force close position(s).

- deposit the margin amount; or

- transfer from other Phillip accounts; or

- close out position

If equity falls below the required margin level or has negative balance when market opens after weekend or holiday, Phillip will make best effort to call client margin or force close position(s) at market price. Client shall remain liable for any deficit in the account.

Phillip will notify client any force liquidated position(s) by telephone, email or message, and also have those transactions identified in statement. If the force liquidation is not sufficient to cover negative balance in the account, client shall remain liable for any deficit in the account.

風險聲明:

此網頁內所載之內容不應理解為買入或出售任何產品或服務之建議、邀請、廣告或勸誘。本網頁有關人士對於網頁所提供的任何資料或意見均屬可靠,惟其所產生之任何損失或虧損概不負任何責任。金融市場具一定風險,投資價格可跌可升。 買賣期貨合約的虧蝕風險可以極大。在若干情況下,你所蒙受的虧蝕可能會超過最初存入的保證金數額。即使你設定了備用指示,例如“止蝕”或“限價”等指示,亦未必能夠避免損失。市場情況可能使該等指示無法執行。你可能會在短時間內被要求存入額外的保證金。假如未能在指定的時間內提供所需數額,你的未平倉合約可能會被平倉。然而,你仍然要對你的帳戶內任何因此而出現的短欠數額負責。因此,你在買賣前應研究及理解期貨合約,以及根據本身的財政狀況及投資目標,仔細考慮這種買賣是否適合你。

Top of Page

|

Please contact your account executive or call us now. Foreign Futures Tel : (852) 2277 6677(Mon. 7:00 am ~ Sat. 5:00 am) Email : futures@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|