-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

Research Report

China Youzan (8083.HK) - 2020 Result meet expectation with strong momentum in offline commerce SaaS business

Wednesday, April 14, 2021  7337

7337

China Youzan(8083)

| Recommendation | Buy |

| Price on Recommendation Date | $2.370 |

| Target Price | $3.940 |

Weekly Special - 3306 JNBY Design Limited

Investment Summary

The company has made adjustments on its revenue breakdown structure, transaction fee and extended service revenue are now included in the merchant solution segment.

In the 2020 result announcement, the company has made adjustments on its revenue breakdown structure. The revenue is now separated into three segments, namely subscription solutions, merchant solutions and others. The company SaaS sector is now classified as subscription solution, while transaction fee and extended service revenue are now included in the merchant solution segment. The remaining businesses of the company are included in the other segment.

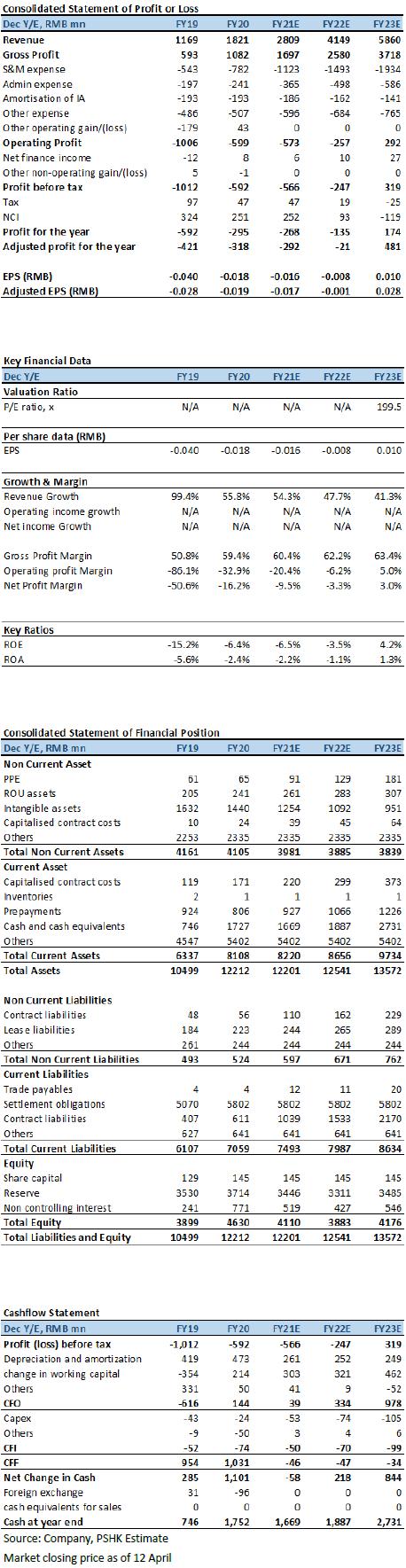

The 2020 results meet expectation, with a positive cash flow from operating activities

The company's 2020 revenue was RMB 1.821 billion (+55.8% YoY), which is in line with our previous forecast (previous forecast was RMB 1.822 billion). The revenue from subscription solution was RMB 1.048 billion (+76.6% YoY). The revenue from merchant solution was RMB 757 million (+33.7% YoY) and the revenue from other business was RMB 15 million (+78.1% YoY). The revenue proportion of the three segments were 57.6%/41.6%/0.8% respectively. The growth rate of merchant solution revenue was significantly slower than that of GMV (GMV growth rate over the same period was 60.8%). The main reason was that the company's merchant solution revenue in 2019 includes transaction fee revenue generated from non-Youzan business. If the relevant revenue was excluded, the 2020 revenue growth of merchant solution was in line with the GMV growth, which matches with the link-with-GMV charging model of the merchant solution segment. The revenue from extended services grew 84% YoY and exceeded the growth of the GMV.

As for the GPM, the company's 2020 GPM was 59.4% (+8.7ppts YoY) with GP at RMB 1.082 billion (+82.3% YoY). The GPM was higher than our expectation of 58.2%. In terms of breakdown, the GPM of subscription solutions was 76.0% (+11.8ppts YoY). The GPM of merchant solutions was 37.3% (+0.2ppts YoY) and the GPM of other segment was 18.1% (-5.9ppts YoY). The GPM of merchant solutions was significantly lower than that of subscription solutions. The main reason was that the transaction fee business, which accounts for a large share of revenue in the merchant solution segment, is positioned as a tool for improving the ecosystem, but not for profit. Therefore, the GPM of this sub-segment was basically 0%, which dragged down the overall GPM of the merchant solution segment. According to the management, if the transaction fee business is excluded, the GPM of merchant solutions will be close to 90%.

As for the operating expenses, due to the economies of scales brought by the high revenue growth, the S&M expense ratio/admin expense ratio/other expense ratio all declined in 2020. The company's S&M expense in 2020 was RMB 782 million (+43.9% YoY), corresponding to a S&M expense ratio of 42.9% (-3.5ppts YoY). The admin expense was RMB 241 million (+22.7% YoY), with a corresponding expense ratio of 13.3 % (-3.6ppts YoY). The other operating expense (included the R&D expense ratio) was RMB 445 million, with the corresponding expense ratio of 24.4% (-5.5ppts YoY). The company's net loss attributable to the parent in 2020 was RMB 295 million (-50.2% YoY), which was slightly better than our previously expected RMB 331 million. As for the cash flow, the company recorded a positive operating cash flow for the first time in 2020. The net cash flow from operating activities was approximately RMB 144 million, a significant improvement from the RMB -616 million recorded last year.

The company's business is expanding rapidly, with a steady growth in the operating indicators

The company's GMV in 2020 was RMB 103.7 billion (+60.8% YoY), which is in line with expectations. The company's overall monetization rate (revenue/GMV) was 1.76%, which was basically the same YoY. On the other hand, the company continues to create value for merchants. In 2020, the average annual GMV of merchants exceeded the one-million mark for the first time, reaching RMB 1.067 million (+36.3% YoY).

In 2020, the number of new paying merchants was 59,940 (+9.6% YoY). More specially, the number of new paying merchants of Youzan Chain increased by nearly 300% YoY and the number of new paying merchants of Youzan Retail, Youzan Beauty, Youzan Education increased by 100% YoY, respective. In terms of the paying merchants, the number of paying merchants at the end of 2020 was 97,158 (+18.0% YoY), which was lower than our previous forecast. The adjusted paying merchants (included the 3686 trading Youzanke traffic providers) was 100,844 (+22.5% YoY). More specifically, the number of chain merchants has increased significantly, up by about 900% YoY. As of the end of December, the company's target merchants (ie merchants with annual GMV higher than RMB 36,000) rose 30% YoY, accounting for 45% of total merchants (+4.0ppts YoY). But the target merchant renewal rate dropped slightly YoY to 74%(-6ppts YoY).

As more and more KAs use the company's products, the company's average contract value (ACV) increased significantly. In 2020, the ACV reached RMB 11,880 (+33.3% YoY). The ACV of Youzan Chain grew the most in 2020, which has a greatest stimulating effect on the company's overall ACV improvement. We believe that the ACV still has a lot of room for growth in the future, especially after the rise in price of products in early 2021. On the other hand, the company's overall ARPU for 2020 was RMB 18,600 (+39.8% YoY), of which the subscription solution APRU was RMB 10,800, which beat our previous expectation, while the merchant solution ARPU was RMB 7,800.

Future Strategies

In the future, the company will continue to take increasing GMV of merchants as their first priority and continue to generate value for merchants. As part of the company's revenue is linked with the GMV, it has established a win-win relationship with the merchants. The company's target GMV for 2025 is RMB 1 trillion, representing a 10-fold increase in 5 years. In the future, the company will further discover the needs of merchants and provide the most effective solutions targeting the perspective of the merchants` needs.

China currently has many merchants in low-tier cities and non-core business districts in high-tier cities. These merchants have great demand for systematic software in the SaaS format. Therefore, the company is planned to launch products that target their needs in 2021 in order to improve their operation and promotion efficiency. On the other hand, the company will continue to improve its software customization capabilities and operation capabilities for the KAs to improve the operating efficiency and business scale of the KAs.

In the future, the company will continue to expand its sales network, including its direct sales team and channel sales network, and increase its penetration in multiple sales regions to reach more diversified merchants. Finally, the company will continue to innovate and expand its solution portfolio, including continuous linkage with third-party CRM/ERP developers through system integration to provide merchants with a more comprehensive solution.

Valuation and Investment Thesis

Since 1) the 2020 growth of paying merchants of subscription solution was slower than our expectation 2) the 2020 growth of ARPU of subscription solution was higher than what we previously expected, we adjust our 2021/2022 forecast revenue downward to RMB 2.81/4.15 billion (our previous forecast was RMB 3.00/4.35 billion) and introduce our 2023 revenue forecast of RMB 5.86 billion. We have switched our valuation model to SOTP and apply a target 2022 PS of 30x to SaaS and extended services and a target 2022 PS of 8x to transaction and other services. We trim of TP to HKD 3.94. We maintain BUY rating. (Market closing price as of 12th April) (exchange rate: RMB 0.85/HKD)

Risk

1) The delay in Youzan Technology listing and take private of China Youzan

2) The expansion of SaaS customers is worse than expected

3) The increased industry competition

4) GMV increase less than expected

5) Merchants renewal rate less than expected

Financial Statements

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|