-

Products

- Local Securities

- China Connect

- Grade Based MarginNEW

- Stock Borrowing & Lending

- IPO

- Stock Options

- Foreign Stocks

- Unit Trust

- Local Futures

- Foreign Futures

- Forex

- Bullion

- Insurance Services

- Bond

- Monthly Investment Plan

- Mortgage

- Other Services

- Surplus Cash Facility

- Phillip Premier

- Latest Insurance Promotion<

- ETF

- Smart Minor (Joint) Account

- Capital Management

- Research

- Market Info

- Education Center

- Phillip Apps

- Customer Service

- About Us

-

Surplus Cash Facility

A-Share Research Report

The articles are produced in Chinese only.

Author

章晶小姐 (Zhang Jing)

高級分析師

高級分析師

本科畢業於同濟大學工科,碩士畢業於華東師範大學金融貿系。現為輝立証券持牌高級分析師,主要負責汽車及航空板塊的研究,曾獲得《華爾街日報》亞洲區2012年度汽車及零部件最佳分析師第二名,擅長將行業前景與上市公司結合分析。

Bachelor Degree in Tongji University of Engineering; Master Degree in East China Normal University of finance. Currently cover automobile and air sectors. Having worked in research for years and is good at combining analysis for the companies with industry prospects.

| Phone: | 86 21 51699400-103 | Email: | zhangjing@phillip.com.cn | |

JOYSON Electronics (600699.CH) - Ongoing R&D Innovation around Intelligent Electric Reform of Vehicles

Friday, November 29, 2024  5523

5523

JOYSON Electronics(600699)

| Recommendation | BUY |

| Price on Recommendation Date | $15.560 |

| Target Price | $20.000 |

Company Profile

Joyson Electronics stands as a leading global supplier in the fields of automotive electronics and safety. It offers one-stop solutions across critical technologies for intelligent electric vehicles to automotive OEMs around the world. The Company mainly engages in automotive electronics and automotive safety. In the former segment, it focuses on intelligent cockpit systems, intelligent network connection, intelligent driving and new energy management. In the latter segment, it focuses on seatbelts, airbags, intelligent steering wheels and integrated safety solutions.

Investment Summary

Strong Revenue Performance

According to the 2024 Q3 report released by Joyson Electronics, the Company recorded operating revenue of RMB41,135 million, down 0.42% yoy, net profit attributable to the parent company of RMB941 million, up 20.90% yoy, and net profit attributable to the parent company excluding non-recurring items of RMB941 million, up 40.25% yoy, in the first three quarters of 2024, and operating revenue of RMB14,056 million, down 1.68% yoy and up 1.85% qoq, net profit attributable to the parent company of RMB305 million, up 0.50% yoy and down 7.73% qoq, and net profit attributable to the parent company excluding non-recurring items of RMB305 million, up 10.09% yoy and down 7.46% qoq, in 2024 Q3. Comparatively, global light vehicle output declined by 4.8% yoy in 2024 Q3 and the cumulative output declined by 1.8% yoy in the first three quarters, according to S&P Global's disclosure in October 2024.

Remarkable Results was Achieved in Cost Reduction and Efficiency Improvement, with Continued Optimization of Cost

In the first three quarters of 2024, Joyson Electronics's overall gross margin steadily grew by 1.6 ppts yoy to approximately 15.6%. In Q3 in particular, the gross margin stood at 15.74%, reflecting a yoy increase of 0.81 ppts and a qoq increase of 0.24 ppts, respectively, and the net profit margin at 3.03%, marking a yoy increase of 0.42 ppts and a qoq decrease of 0.28 ppts, respectively, underscoring continued improvement of the profitability of the Company's principal business. By business segment, the Company's automotive safety business reaped a revenue of RMB28.4 billion, with a gross margin of 14.0%, up 2.6 ppts yoy, in the first three quarters. Ongoing enhancements in business operations in Europe and the Americas drove the performance of automotive safety business to boost on a qoq basis for consecutive quarters. All four major business regions of the Company began to generate profits, contributing significantly to its performance growth. In the first three quarters, the Company's automotive electronics business generated operating revenue of RMB12.7 billion, with a gross margin of 19.2%, remaining relatively stable.

In 2020, the Company has won more than RMB59.6 billion worth of new orders for To guarantee long-lasting competitiveness in emerging business sectors and sustained conversion of new business orders into future operating revenue, the Company maintained a steady level of investment in R&D, which slightly affected the net profit in Q3, along with the increase in income tax expense arising from the continued recovery of the profitability of the Company's overseas operations. In 2024 Q3, the Company's period expense ratio was 11.33%, marking a yoy decrease of 0.75 ppts and a qoq increase of 0.80 ppts. Specifically, the sales expense ratio was 0.93%, up 0.03 ppts yoy, the management expense ratio was 4.31%, down 0.93 ppts yoy, the R&D expense ratio was 4.57%, up 0.23 ppts yoy, and the finance expense ratio was 1.51%, down 0.09 ppts yoy.

Orders of New Business Surged and Domestic Share Increased

Joyson Electronics intensified efforts to increase its share in the Chinese market, focusing particularly on leading domestic self-owned brands and new forces of vehicle manufacturing. In the first three quarters of 2024, the Company gained new orders worldwide amounting to approximately RMB70.4 billion cumulatively, up 19.3% yoy. New orders for new energy models, amounting to approximately RMB37.6 billion, up 7.4% yoy, accounted for 53.4% of all new orders. From the business segment perspective, new orders in the automotive safety segment reached approximately RMB49.1 billion, a yoy increase of 44.4%, and new orders in the automotive electronics segment reached approximately RMB21.4 billion, a yoy decrease of 14.4%. From a regional perspective, the Company continued to strengthen its position in the Chinese market and its cooperation with self-owned brands and emerging vehicle manufacturers. New orders from China amounted to approximately RMB31 billion, up 24% yoy, accounting for around 44% of the Company's total orders from China, a yoy increase of 2 ppts. Notably, the proportion of orders from leading self-owned brands and emerging vehicle manufacturers saw consistent growth, demonstrated by the full coverage of top 10 new energy vehicle brands/manufacturers on the sales leaderboard in the automotive safety business segment.

Ongoing R&D Innovation around Intelligent Electric Reform of Vehicles

The Company promptly seized the opportunities brought by the rapid development of intelligent electric vehicles, and deepened business layout and increased R&D input in intelligent electric vehicles, with enrichment of business categories. In the first three quarters, the Company explored emerging business, such as the UWB technology solution (consisting of the digital key and the in-cabin life detection radar), the ADAS L2 Smart Camera (front view all-in-one) solution and the vehicle-road-cloud integrated system, in the fields of intelligent driving, intelligent cockpit/network connection systems and body area intelligence. As the Company continues to increase R&D input and actively expands business categories, its competitiveness in emerging business is expected to enhance on an ongoing basis.

Investment Thesis

As a global leader in automotive safety and electronics, the Company has maintained sound development while actively capitalizing on the opportunities brought by rapid development in the intelligent electric vehicle sector. In this regard, its orders on hand will continue to grow, underscoring a promising outlook for its future growth.

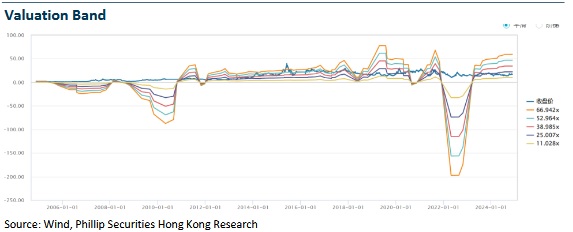

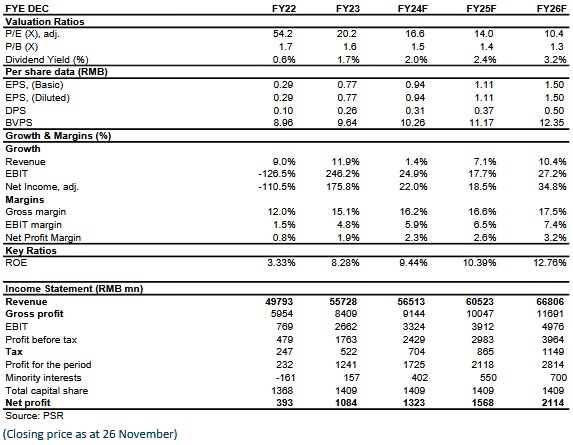

We expect Joyson's EPS for 2024/2025/2026 to be 0.94/1.11/1.5 yuan. We revised the target price of RMB 20 equivalent to 21.3/18/13.3x E P/E and assign Buy ratings. (Closing price as at 26 November)

Risk

Operating collision in Joyson's M&A

Worse-than-expected downstream demand

Financials

This report is produced and is being distributed in Hong Kong by Phillip Securities Group with the Securities and Futures Commission (“SFC”) licence under Phillip Securities (HK) LTD and/ or Phillip Commodities (HK) LTD (“Phillip”). Information contained herein is based on sources that Phillip believed to be accurate. Phillip does not bear responsibility for any loss occasioned by reliance placed upon the contents hereof. The information is for informative purposes only and is not intended to or create/induce the creation of any binding legal relations. The information provided do not constitute investment advice, solicitation, purchase or sell any investment product(s). Investments are subject to investment risks including possible loss of the principal amount invested. You should refer to your Financial Advisor for investment advice based on your investment experience, financial situation, any of your particular needs and risk preference. For details of different product's risks, please visit the Risk Disclosures Statement on http://www.phillip.com.hk. Phillip (or employees) may have positions/ interests in relevant investment products. Phillip (or one of its affiliates) may from time to time provide services for, or solicit services or other business from, any company mentioned in this report. The above information is owned by Phillip and protected by copyright and intellectual property Laws. It may not be reproduced, distributed or published for any purpose without prior written consent from Phillip.

Top of Page

- Friendship Links

- HKEX

- CNFOL HK

- Tencent HK

- SSE

- SZSE

|

Please contact your account executive or call us now. Research Department Tel : (852) 2277 6846 Fax : (852) 2277 6565 Email : businessenquiry@phillip.com.hk Enquiry & Support Branches The Complaint Procedures |

About Us Phillip Securities Group Join Us Phillip Network Phillip Post Phillip Channel Latest Promotion |

E-Check Login |

Investor Notes Free Subscribe |

|

Contact Us

Research Department

Tel : (852) 2277 6846

Fax : (852) 2277 6565

Email : businessenquiry@phillip.com.hk

Enquiry & Support

Branches

The Complaint Procedures

About Us

Phillip Securities Group

Join Us

Phillip Network

Phillip Post

Phillip Channel

Latest Promotion

Phillip Securities Group

Join Us

Phillip Network

Phillip Post

Phillip Channel

Latest Promotion